What's an IUL?

IUL stands for "Indexed Universal Life" insurance

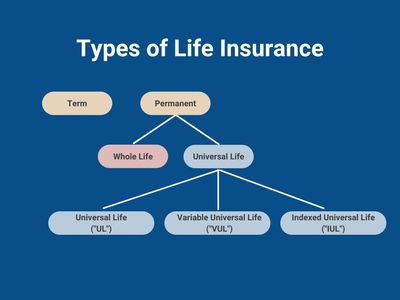

There are two main types of life insurance: Term and Permanent. IUL is a form of permanent life insurance

Term Life Insurance

Term life insurance is life insurance that only lasts for a specific period of time; typically 10-30 years. The cost or premium payments for term insurance are generally fixed throughout the life of the policy

For example, assume you buy a 20-year term life insurance policy that has $1,000,000 of death benefit. Further assume the required premium for the policy is $1,000 per year. So long as you continue paying the $1,000 in annual premiums on time every year you're alive, the insurance company will pay your beneficiary(ies) $1,000,000 if you die any time during those 20 years

Conversely, if you don't die within those 20 years (and don't otherwise extend or convert your policy to other coverage), the policy simply expires after 20 years. You no longer have to continue paying the annual premium payments after the policy ends, but you also have no sort of residual value

Permanent Life Insurance

Whereas term life insurance only lasts for a specific length of time, Permanent life insurance lasts permanently...for the life of the insured. Though it should be noted that the word "permanent" is a bit of a misnomer as permanent policies generally have a maturity date. If the insured is still alive as of the maturity date, the policy is typically involuntarily surrendered by the insurance company at that point. Older permanent policies commonly mature if/when the insured reaches age 90 or 95. Newer permanent policies generally mature if/when the insured reaches age 120

In addition to providing life insurance for a longer period of time than term policies, permanent policies also have a cash value accumulation feature whereas term policies do not. More on cash value in a bit...

Within the category of permanent life insurance, there are two main sub-categories or types of policies; Whole Life and Universal Life (there is also Variable Life, but it's less common than Whole Life or Universal Life, so I'm excluding it here)

Permanent Life Insurance - Whole Life Insurance

There are many ways in which whole life insurance policies can be customized, but the basic structure is such that the amount of death benefit you purchase is fixed and guaranteed for the life of the policy, as is the amount of premium payments required to be paid. In other words, so long as you pay $X of premium payments every year, the beneficiary(ies) will receive a death benefit of $Y upon the passing of the insured

With each whole life policy premium payment that's made, some is used to pay for the cost of the insurance, some is used to pay the other costs and fees of the policy and the remainder is put into a cash accumulation feature. This "cash value" is money that the policy holder owns. Cash value can be taken out of the policy through outright distributions, or it can be borrowed against whereby the insurance company will extend a personal loan to the policyholder using the policy's cash value as collateral

The policy's cash value earns interest. Specifically, in a whole life policy, the rate of interest is fixed and guaranteed for each interest crediting period. Assume the policy is structured such that the cash value is credited with interest once per year. At the start of each interest crediting period, the rate of interest will be known and fixed. For example, assume there is currently $100,000 of cash value in the policy and a new annual interest crediting period is starting. Further assume the insurance company informs you the interest rate for the new crediting period will be 4%. At the end of the period, the cash value will be credited with $4,000 of interest, bringing the total cash value to $104,000 (plus any portion of additional premium payments that went into the cash value during the year)

Permanent Life Insurance - Universal Life Insurance

Like whole life, Universal Life Insurance policies are similarly permanent policies where coverage lasts for the life of the insured and some of the premium payments go into cash value. However, the main difference between whole life and universal life is that the amount of premium is flexible in universal life policies whereas premium is typically fixed in whole life policies

For example, in a universal life policy, the policyholder could choose to pay less - or nothing - in premiums for a given year, so long as there is enough cash value in the policy to cover that year's policy costs and fees. Conversely, in a whole life policy, even if the amount of cash value is in excess of the annual costs and fees of the policy, the policyholder would still need to make the agreed upon fixed annual premium payment (where some of the premium would be used to pay that year's costs and fees of the policy, and the rest would go into the policy's cash value)

Within the Universal Life Insurance sub-category of the Permanent Life Insurance category, there are three types of policies: Universal Life (yes, you read that correctly...one of the sub-categories of the broader Universal Life category is also called Universal Life), Variable Universal Life and Indexed Universal Life

Permanent Life Insurance - Universal Life Insurance - Universal Life

A "Universal Life" or "UL" policy is a type of universal life insurance policy where the interest credited to the cash value is a fixed rate. Like with a whole life policy, the interest rate can change each interest crediting period. And, also similar to a whole life policy, once an interest crediting period begins, the rate is fixed and guaranteed for the duration of that period. The interest rate can generally only reset after the current interest credit period ends and a new one begins

Permanent Life Insurance - Universal Life Insurance - Variable Universal Life

A "Variable Universal Life" or "VUL" policy is a type of universal life insurance policy where the interest credited to the cash value is variable and is based on the performance of selected investments held within the policy. The policy's cash value gets invested in mutual fund-like investment accounts that invest in portfolios of stocks, bonds, etc. The policyholder is able to select from a menu of available investment options each interest crediting period. The interest credited to the cash value is directly tied to the performance of the investments selected for the interest crediting period. If the investments go up X%, the cash value will be credited with X% of interest. Similarly, if the investments go down Y%, the cash value will get negative interest such that it will go down Y%

Permanent Life Insurance - Universal Life Insurance - Indexed Universal Life

An "Indexed Universal Life" or "IUL" policy is a type of universal life insurance policy where the interest credited to the cash value is variable and is "indexed," or based on, reference to the performance of an index, such as the S&P 500. Similar to VUL, the policyholder generally does not know the ultimate rate of interest that will be credited to the cash value for each interest crediting period. However, different from a VUL is the fact that the interest credited to the cash value can never be less than zero

This is because, unlike with VUL policies, IUL policies do not directly invest their cash value in securities or traditional investments. Instead, the insurance company promises to credit an amount of interest that's zero or larger based on a pre-agreed formula that references the return of an underlying index selected by the policyholder. The formula uses some combination of Participation Rates, Caps and/or Spreads

- A Participation Rate is how much of the reference index's return is applied as interest for the policy's cash value. For example, a participation rate of 50% means the policy's cash value will be credited interest equal to 50% of whatever the return was of the selected index. Assume the selected index is the S&P 500, and its price increased 10% during the interest crediting period. A participation rate of 50% means the policy's cash value would be credited 5% interest for that period (i.e. the cash value interest is only participating in 50%, or half, of the S&P 500's 10% price return)

- A Cap is a ceiling on how much interest will be credited to the cash value during any interest crediting period. For example, a cap of 8% means the cash value will not be credited with more than 8% interest for the period. Assume the selected index is the S&P 500 and its price increased 10% during the interest crediting period. Further assume there is a 100% participation rate. A cap of 8% means the policy's cash value would be credited with 8% interest for that period (i.e. 100% participation of the S&P 500's 10% price return, but subject to the 8% cap)

- A Spread is a reduction in interest crediting from the amount of interest that would have otherwise been credited. For example, a spread of 2% means the interest credited will be 2% lower than it otherwise would have been. Assume the selected index is the S&P 500 and its price increased 10% during the interest crediting period. Further assume there is a 100% participation rate and an 8% cap. A spread of 2% means the policy's cash value would be credited with 6% interest for that period (i.e. 100% participation of the S&P 500's 10% price return, but subject to the 8% cap AND reduced by the 2% spread)